Recap

This is not financial advice. Do your own research. Invest what you can afford to lose.

On February 10, 2026, we entered the stock market and sold our first insurance policy!

We promised a buyer that if their Intel stock falls below $41 by March 20, 2026, we will buy their shares for $41.

Intel sells computer chips for laptops, desktops, and datacenters.

Each policy we sell covers 100 shares.

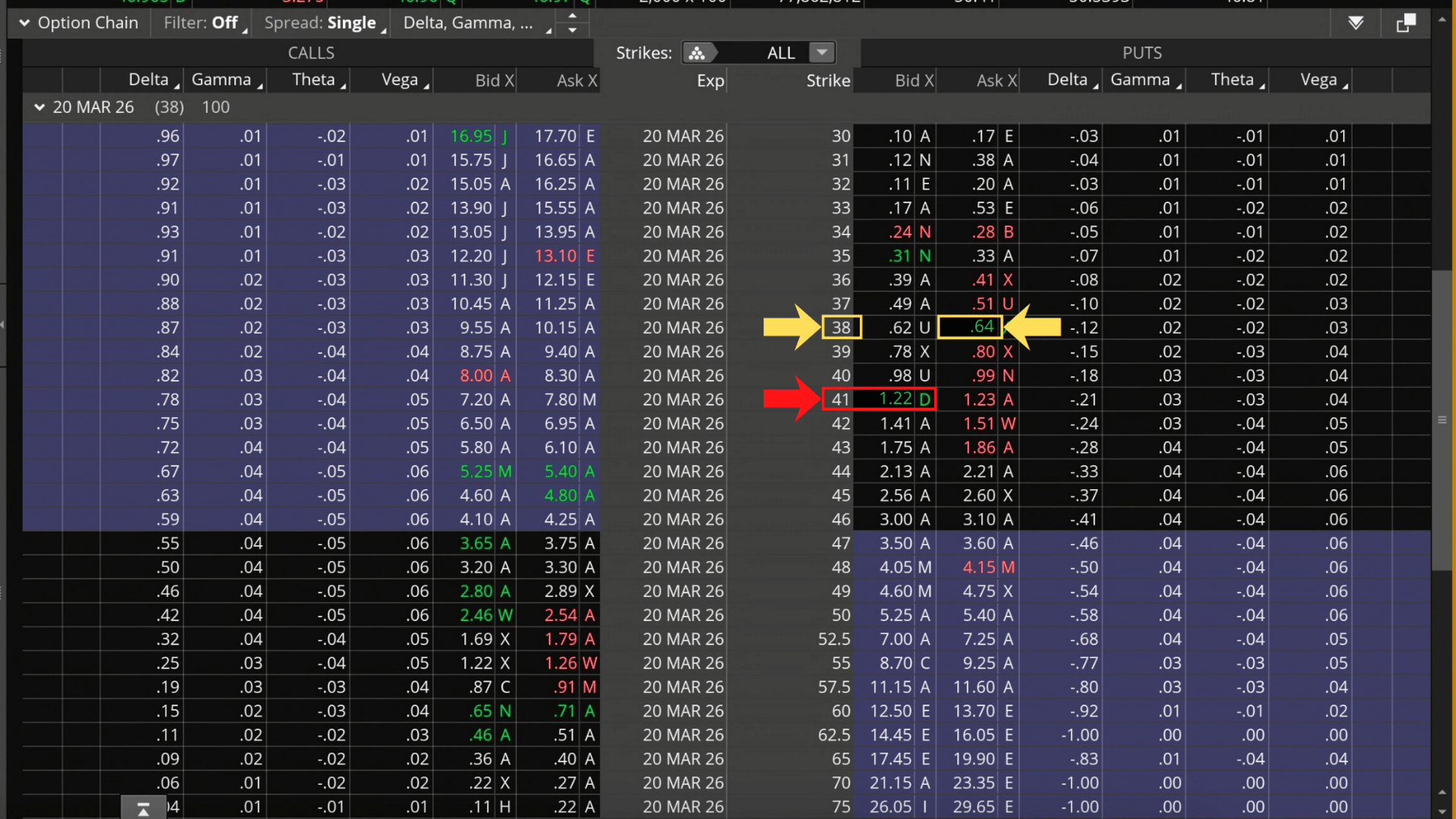

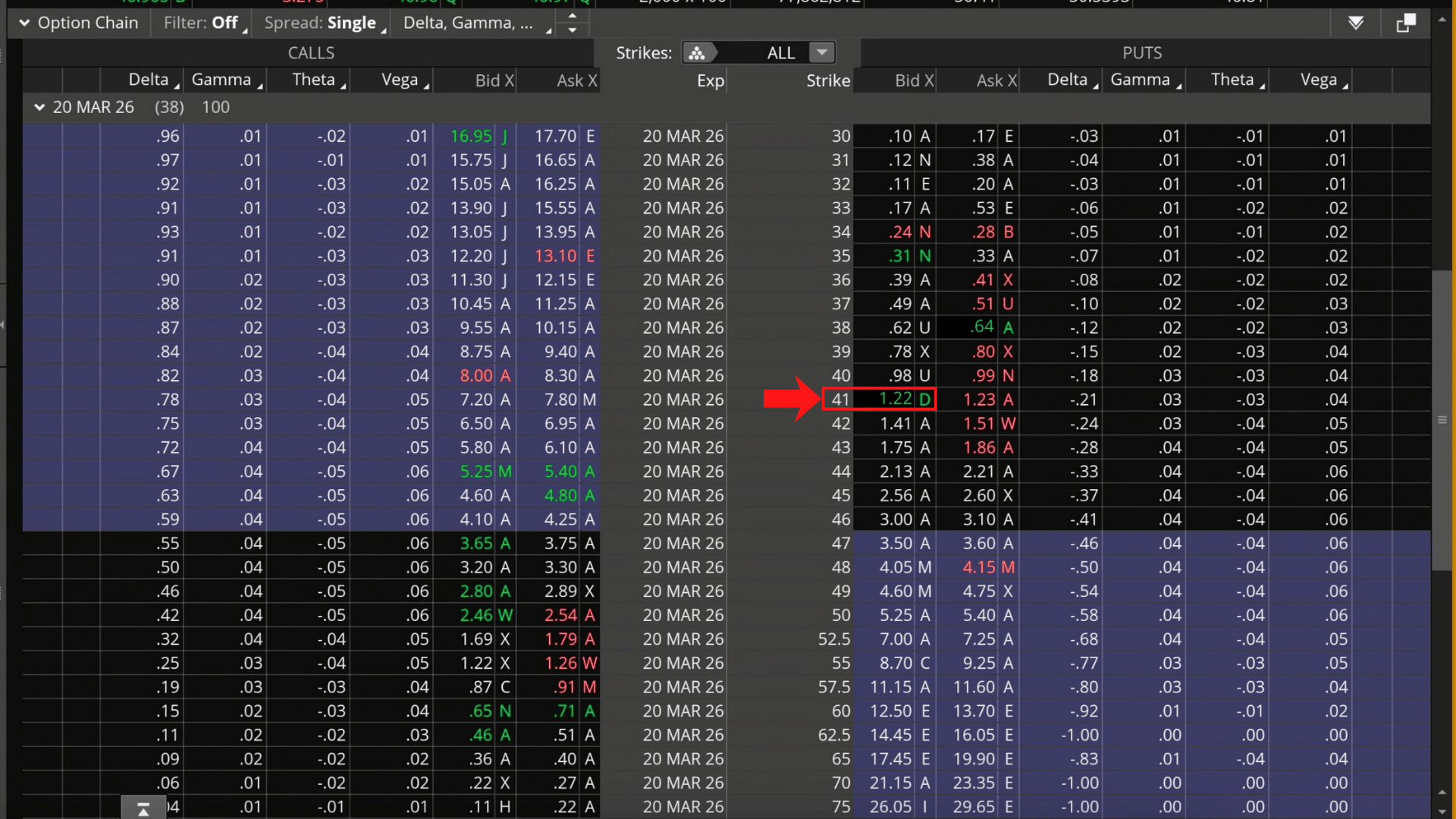

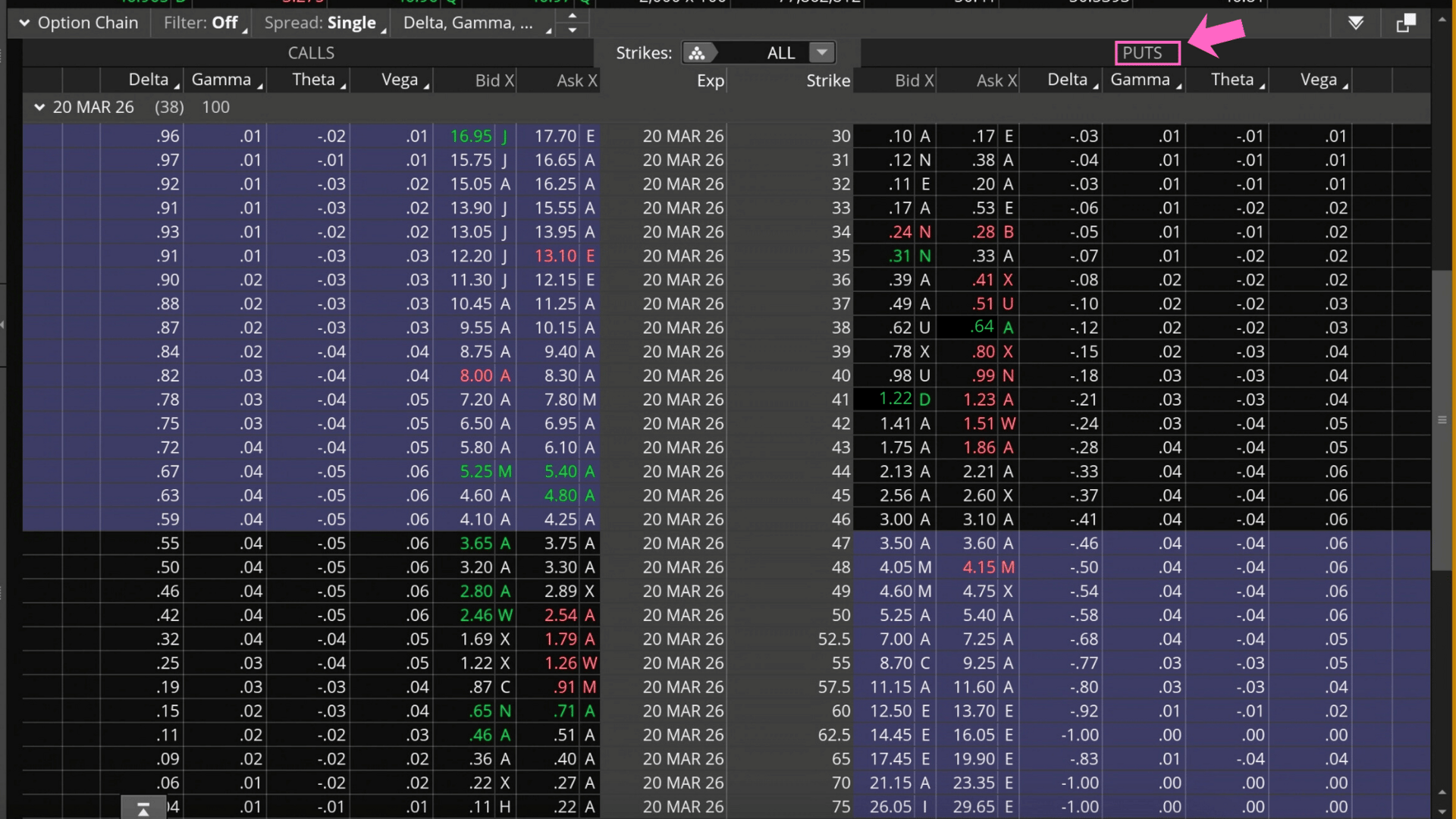

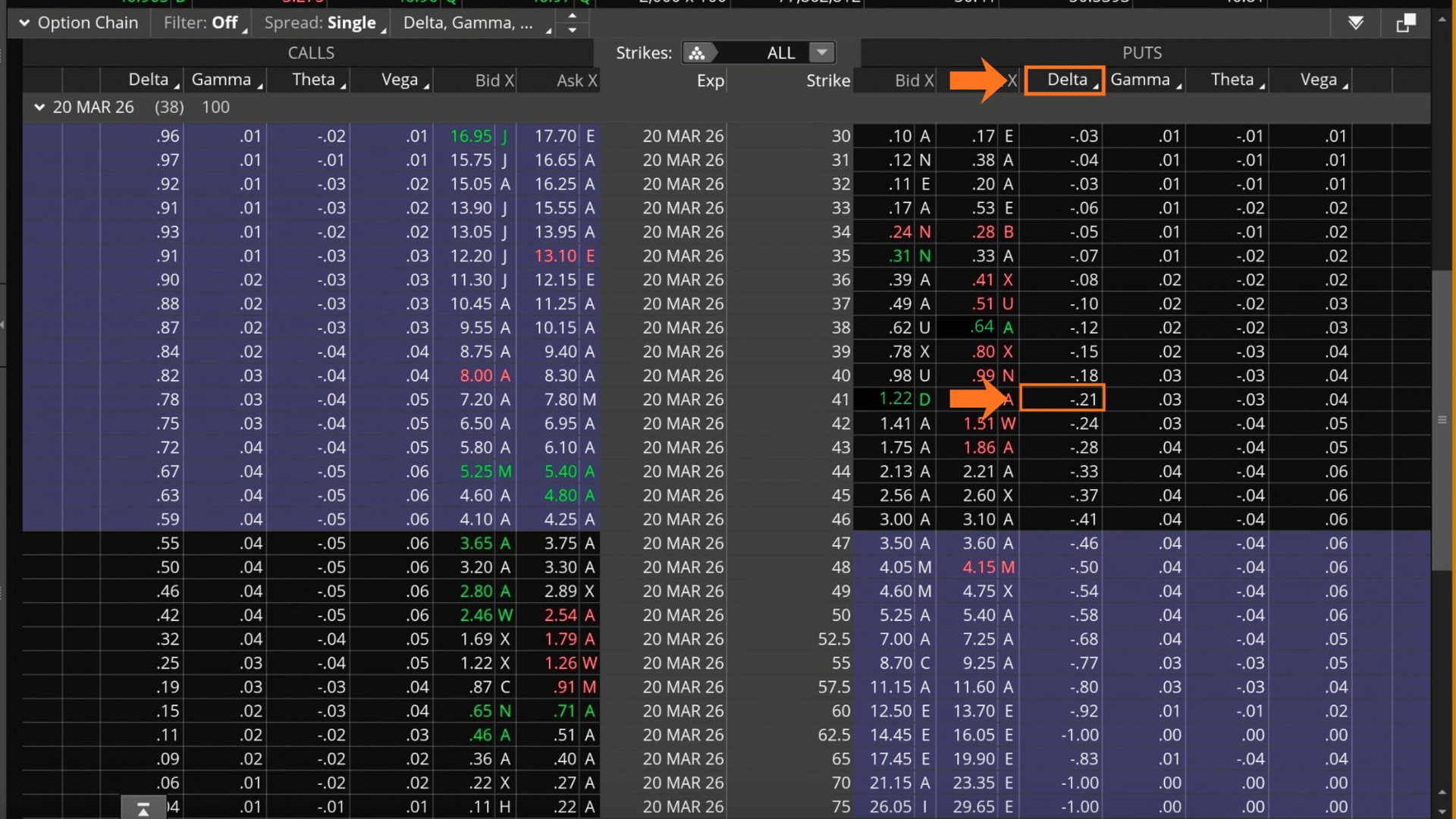

(I edited the images below to help readers understand the process. I use thinkorswim from Charles Schwab to do the transactions. Focus on the numbers in the colored box.)

The buyer paid us $122 for the policy.

$1.22 × 100 shares = $122

Charles Schwab charges a $0.65 commission when we buy or sell options. The money we received after paying the commission is $121.35

$1.22 × 100 shares - $0.65 commission = $121.35 gross income received.

If Intel stays above $41, we keep $121.35.

Intel was $47 when we sold the policy. The stock needs to fall more than $6 or 13% before we suffer a potential loss. 13% gives us a nice safety cushion.

Just in case Intel collapses, we bought our own insurance for $64 to protect ourselves. If Intel falls below $38, our loss is capped.

$0.64 × 100 shares = $64 spent on protection.

Charles Schwab charged another $0.65 commission for this protection.

$0.64 × 100 shares + $0.65 commission = $64.65 spent on protection.

In total, our net income was $56.70.

$121.35 income received - $64.65 paid for our own protection = $56.70 net income received

Policy Details

We agreed to buy Intel if the stock falls below $41. We did this transaction by SELLING a PUT OPTION at $41.

A put option seller is REQUIRED to buy a stock if it falls below a certain price.

A put option buyer has the RIGHT to sell their stock for more if it falls below a certain price.

Right vs Required

Think of when someone has a car accident. The driver who bought insurance has the right to demand that GEICO fixes their car.

If the driver files a claim, GEICO is required to fix their car.

If Intel falls below $41 and the buyer calls us, we are required to buy their shares at $41. Even if Intel goes bankrupt and falls to $0, we are still required to buy their stock for $41.

In return for our guarantee to buy Intel at $41, the buyer paid us $1.22 for each share covered by the policy. Each policy covers 100 shares.

The gross income we received was $122 minus the $0.65 commission.

The picture below shows the put option we sold at $41 for $1.22.

We sold 1 contract.

If we sold 2 contracts, we would receive $244

$1.22 per share × 100 shares × 2 contracts = $244

Some investors sell thousands of contracts.

Buying Our Own Protection

We also bought a put option to limit our losses. We paid $0.64 cents per share for this protection.

The put option cost us $64.65

$0.64 × 100 shares + $0.65 commission = $64.65

If we don’t buy protection and Intel falls more than 13%, we would have to buy 100 shares of Intel at $41, which amounts to $4,100.

This is fine if we want to buy and hold Intel, but in this deal we just want to collect the income and not own the stock. The protection we bought limits our loss to $243.30.

Each $1 between $41 and $38 represents $100.

($41 - $38) × $100 = $300 potential loss

If Intel falls to $38 or below, we can lose $300 minus the $56.70 income we received upfront.

$300 potential loss - $56.70 income received = $243.30 maximum potential loss

Our stock broker holds this $243.30 until the transaction ends. They release it to us afterwards.

When we combine the $41 option we sold, the $38 option we bought, and the money we received upfront, the transaction we did is called a Put Credit Spread.

Exit Strategy

Although the policy we sold ends on March 20th, we plan on exiting the deal by February 20, God willing.

Why? Risk management.

NVIDIA, the chip company dominating AI, will release their financials on Wednesday, February 25, 2026.

Intel and NVIDIA are in the same industry and it’s uncertain what NVIDIA will report. If they report something negative, Intel might drop. We want to avoid this risk.

We must spend some of the $56.70 we received to exit this deal.

How much of the $56.70?

Not sure. We’ll see when the time comes.

Some people might ask, why risk $243.30 just to make less than $56.70?

Remember, investing is a percentage return game.

$56.70 income ÷ $243.30 maximum potential loss = 23.30% return

Even though the return will be lower because we’re exiting early, we’re starting off with a good return. If we pay a $28 fee to exit the deal, we’ll have $28.70 left, which gives us an 11.80% return.

$28.70 income ÷ $243.30 max potential loss = 11.80%

If we pay $40 to exit, we’ll have $16.70 left, which is a 6.9% return in less than 2 weeks.

We would never get this return from our savings account.

Risk

Selling options is risky because stocks can fall in the blink of an eye. In a market crash, the money we made upfront can easily get washed away.

To run a successful insurance business, we must pay attention to risk.

In this letter, we mentioned a few risk reducing strategies.

We sold the policy 13% below the stock price for a nice cushion.

We sold a policy that has a 79% chance of success. (This is based on the option’s .21 Delta, which I’ll explain later.)

We bought protection to limit our losses to $243.30.

We plan to exit the deal before a major uncertain event occurs.

In future letters, I will elaborate on other strategies we can use to reduce our risks.

I hope no one told you the insurance business was easy.

Like GEICO, our goal is to take calculated risks, and to make more money than we pay out.

Only invest what you can afford to lose.

More of the Chart Explained

(Focus on the items in the colored box)

Pink

Puts: The section investors check if they want to buy or sell insurance.

Orange

Strike: The price our policy gets triggered.

Bid: The price buyers will pay for insurance. A buyer was willing to pay us $1.22 for our insurance.

Ask: The price sellers ask for their insurance. A seller sold us insurance for $0.64.

Delta: The probability of our insurance policy losing money.

Our delta is .21 which means there is a 21% chance we’ll lose money on this transaction. A 79% chance we make money.

Lime Green

When the policy (contract) expires.

Our policy expires March 20, 2026. 38 days from when we entered the contract.

If you have any questions, don’t hesitate to email me at [email protected]

Until next time, stay strong, stay blessed, and God willing, we’ll see each other next week.

Remember

“An intelligent heart acquires knowledge, and the ear of the wise seeks knowledge.” Proverbs 18:15 (ESV)

Sponsored by Making It Straight

Genesis 12: A Faithful Wife: Watch Abram’s faithful journey into the Promised Land and see the unwavering devotion of Sarai, his wife, to her husband.

Visit www.makingitstraight.com to watch short films based on the Bible and to purchase tools to help evangelize.

The Best Investment Book for Beginners

SIGE is a simple model that anyone can use to analyze their investments. The SIGE Model helps investors focus on the most important elements of any investment:

Safety of their money in the investment. Income from the investment. Growth of the investment. Evaluate the combined factors.

Learn how to avoid investments that are doomed to fail from the beginning.